AdRoll's 2024 Customer Love Week: 6 New Improvements to AdRoll

This is our second biannual Customer Love Week, and each year we wrap the week with product improvements customers have been asking for. Check out what we’ve worked on.

Read More

For advertisers, the 2024 holiday season will be different. While we’ve weathered many outlying holiday events over the recent years (for instance, the COVID-19 pandemic altering shopping behavior for consecutive years), 2024 will have several factors convening to make itself unique as well.

Since this year’s peak holiday shopping season, from Thanksgiving to Christmas, is 5 days shorter than last year, the window to capture shoppers’ interest is smaller than usual — the shortest it’s been in 5 years.

What’s more, the shortened holiday shopping season will further add pressure to the shipping logistics, increasing shipping costs and risks of delay. Further shortening the holiday season is consumer attention on the U.S. election pulling interest away from shopping, with CPM rising on channels that support political ads.

However, there’s still opportunity to take advantage of the improving economic landscape: eMarketers projects ecommerce sales in the 2024 holiday shopping season will grow 9.5%, the fastest since 2021. The key is to be highly intentional about how you use the next few months to drive full-funnel advertising campaigns.

Let’s go into depth on these challenges so you’re prepared to face them with a clear strategy.

The U.S. election is the closest challenge for advertisers, culminating on Election Day November 5 and carrying through the following days as a winner is confirmed. However, display ad campaigns may have little to fear.

In our experience with retail customers at AdRoll, there’s not a huge channel overlap between ecommerce ads and political ads. For instance, political ad money goes to traditional TV, then for political digital advertising, most goes to CTV. While CTV is a burgeoning opportunity for advertisers, it’s typically used in a multi-channel approach with many other channels pulling the heavy-lifting for direct response ROI.

Additionally, political ads will be heavily targeted toward swing states. Many digital advertisers are running campaigns in high-income dense regions like New York, Texas, Florida, and California, or targeting larger swaths of the population than a particular swing state. However, if you’re a local business operating in a hotspot for political advertising, this is when you’ll expect higher CPMs and competition for attention.

The platform you choose for advertising will also impact whether you encounter friction with political ads. Meta’s CPM has risen since July, with part of this attributable to increased political ad spend. On other social channels that ban political ads, like TikTok and Pinterest, we haven’t seen the same uptick in CPM.

Regardless of the channels and ad types you use, one factor is universal: attention to the election may drive attention away from display ads. In early November, U.S. shoppers will be distracted.

Political advertising isn’t the only challenge for marketers. As we mentioned, we have a five-day shorter holiday window and some holiday events overlap, such as the first day of Hanukkah and Christmas Day. Once shoppers do turn their attention to holiday purchases, each day matters.

For this year, post-Black Friday/Cyber Monday budgets could remain roughly the same as last year, but daily ad spend should be higher with 5 fewer days. This means you have more budget to allocate to the shopping season, but you have to prioritize that smaller holiday window, because final ship dates will only be a couple of weeks after Black Friday.

Make sure you're prepared for post-Black Friday and Cyber Monday beforehand. If you spend the week after Cyber Monday making new ads and confirming promotion details, you'll only have 1–2 weeks to run those campaigns by the time they get up and running. This year especially, it’s important to plan ahead!

In Q4, we're dealing with the last (and often largest) portion of annual marketing budgets. With CPMs reaching annual highs through the peak season, advertisers need to determine daily budgets that effectively promote holiday sales before ‘last ship’ dates- and buying behavior drop-off- in order to prioritize the most effective aspects of Q4.

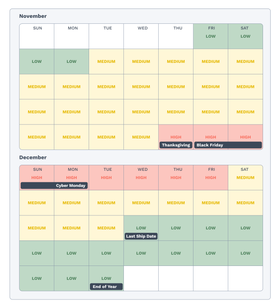

You can think of Q4 spending in three phases: Today to BF/CM, BF/CM to the last ship day, then last ship date to end of year/or new year sale. Breaking it down into these phases, you can see more clearly the general suggestion for how to spend budget on ad campaigns:

Monthly budget approval means Cyber Monday decisions need to be made before the end of October, not finding advertisers short on budget for Black Friday:

Consumers tend to hold off shopping pre-Thanksgiving and wait for the big holiday sales. Ads are important to keep your brand top-of-mind with target customers, but don’t expect a lot of conversions.

During the Black Friday/Cyber Monday period, expect competition to be higher than last year as advertisers may allocate more budget due to the compressed holiday shopping season.

Once we hit December, keep in mind that Cyber Monday this year is already in December when accounting for shipping timelines. Last chance CTAs and reminders will likely be effective this year to compel customers to buy before it’s too late.

Advertisers may be preparing for a turbulent, fast-paced holiday season, but with preparation, they can still see the sales growth eMarketers predicts for 2024.

Be sure to manage company expectations with historic data, and lean on this information when planning campaigns that will help your business excel. Finalize your holiday plans now and get excited for the holidays! If you’re looking for help managing ad campaigns beyond 2024, get in touch with us at AdRoll.

Last updated on October 25th, 2024.